On the 5th of June 2022, IFFO held an in-person workshop as part of its InFocus series, focusing on protein sustainability in aquafeeds. This workshop took place in Sorrento, Italy, ahead of the Twentieth International Symposium on Fish Nutrition and Feeding (ISFNF).

On the 5th of June 2022, IFFO held an in-person workshop as part of its InFocus series, focusing on protein sustainability in aquafeeds. This workshop took place in Sorrento, Italy, ahead of the Twentieth International Symposium on Fish Nutrition and Feeding (ISFNF).

With global aquafeed production presently around 50 million tonnes per annum, up from 13 million tonnes in 2000, never has there been a more urgent need to revisit our understanding of what protein sustainability means in the feed context.

Dr Richard Newton, from the Stirling University, started the workshop, focusing on measuring the sustainability of products and their supply chains and how this measurement applies to aquaculture and marine ingredients.

Life cycle assessment (LCA) measures a variety of impacts, like Carbon Footprint (Global Warming Potential) but also acidification, eutrophication, ozone depletion potentials, as well as water use and land use among others. Overall, there are about 16 different impacts that LCA can provide a metric for. Fish In : Fish Out (FIFO) ratios have recently been incorporated as well, although attempts are being made to add more universal biodiversity metrics such as using natural capital as a reference point.

LCA relies on a value chain perspective: it measures the sustainability of the whole value chain, not just a particular use point, by looking at the production/capture, processing, distribution, consumption, and waste disposal. At each point of the value chain there are impacts and LCA attempts to collate those.

Most of the environmental impacts associated with aquaculture, up to the farm-gate, are related to feed supply (raw materials production and processing) and use (FCR). To assess that impact, scientists need to understand how each of the different ingredients used in a feed contribute in terms of the different LCA parameters.

When looking at a typical marine ingredient production process, there are occurrences where the raw material is diverted into more than one product: fish for direct human consumption and trimmings for instance. Therefore, co-product allocation is critical for data collection and interpretation of any life cycle assessment study. Studies so far have highlighted that the LCA footprint across most metrics for by-products is much lower than that of other ingredients.

“Economic allocation reflects the motivation of the industry in producing something in the first place, and supports the use of by-products as feed ingredients, encouraging processors to find better markets for by-products. However, it requires more sensitive data: at each stage through the life cycle assessment, economic information is required. A lot of work is still needed to fill in data gaps, improve perceptions and communication”, Dr Richard Newton concludes.

Carlos Mera, Head of Agri Commodities Markets at Rabobank, provided his insights on global protein supplies. With Russia and Ukraine dominating in a few agri-commodities and fertilisers, and being key areas of growth before the Russia/Ukraine conflict started, prices at record levels are unlikely to come back down, he explained. Few wheat stocks are available to replace Ukraine’s wheat (a drop of 10-12m tonnes is expected in the coming season).

Carlos Mera, Head of Agri Commodities Markets at Rabobank, provided his insights on global protein supplies. With Russia and Ukraine dominating in a few agri-commodities and fertilisers, and being key areas of growth before the Russia/Ukraine conflict started, prices at record levels are unlikely to come back down, he explained. Few wheat stocks are available to replace Ukraine’s wheat (a drop of 10-12m tonnes is expected in the coming season).

Fertiliser prices are now favouring US’ soy plantings.

La Niña is active and has been limiting Brasil’s crops since 2021. EU and South American crops are also under stress.

While demand for biodiesel is explosive, additional rapid growth is expected in the U.S. Renewable Diesel production capacity in the next three years. Consequently the US is experiencing a vegetable oil supply deficit.

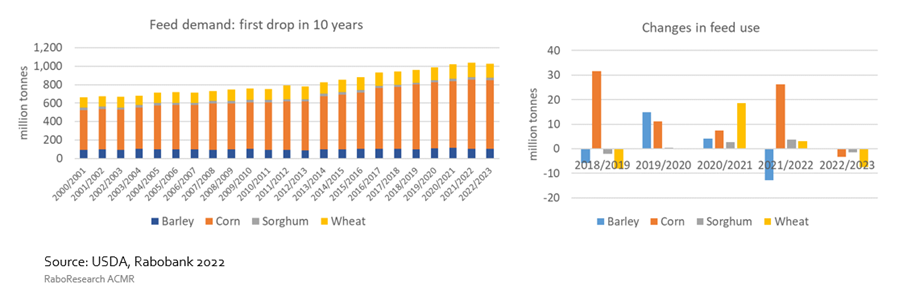

Demand for feed is more flexible, especially given the drop in living standards. Rabobank noted the first drop in feed demand in 10 years. There is a global market potential of half a million metric tonne for insect protein as a pet food and animal feed ingredient he underlined in the end, though it was not clear if there was capacity for this level of production yet.

Dan Lee, Best Aquaculture Practices Standards Coordinator, presented the key trends in the certification landscape: more and more labels cover different stages of the value chain. Furthermore, the emerging sector of LCA is also generating specific guidelines. With NGOs raising awareness on key topics around climate change, animal welfare, etc, there is a need to be more educational and embrace the whole seafood sector, covering both wild and farmed seafood under a unique seafood umbrella. In addition to NGOs, financiers are also taking greater interest and influencing decision making. Therefore, a shift towards social issues is noticeable, with certification standards willing to provide guidelines to encourage continuous improvement.

Dan Lee, Best Aquaculture Practices Standards Coordinator, presented the key trends in the certification landscape: more and more labels cover different stages of the value chain. Furthermore, the emerging sector of LCA is also generating specific guidelines. With NGOs raising awareness on key topics around climate change, animal welfare, etc, there is a need to be more educational and embrace the whole seafood sector, covering both wild and farmed seafood under a unique seafood umbrella. In addition to NGOs, financiers are also taking greater interest and influencing decision making. Therefore, a shift towards social issues is noticeable, with certification standards willing to provide guidelines to encourage continuous improvement.

The presentation led to an informative discussion focusing on how positive changes through certification standards may be demonstrated and communicated in an accessible way, taking into account that action plans are often a shared responsibility with other stakeholders’ actions.

Delbert Gatlin, Professor at the Fish Nutrition Lab - Texas A&M University, USA, delivered a SWOT analysis of plant meals. These rely on well-established production methods and most are by-products of human foods (strengths). However, life cycle assessments for some crops are not good and their nutritional characteristics (fibre, protein, anti-nutrients) may limit their inclusion in aquafeeds. Moreover, climate change and increasing needs from an ever-growing population are potential threats.

On the positive side, Gatlin noted that processing methods such as fermentation and air classification have improved nutritional value of some, while genetic technology has allowed some crops to improve their nutritional value (opportunities).

Starting her presentation on animal proteins, Luisa Valente, Professor at ICBAS-University of Porto and Board Member at CIIMAR, Portugal, clarified what the current state of regulations is: in the EU non-ruminant processed animal proteins have been permitted to be used in aquafeeds since 2013, she explained, adding that the EU authorised the inclusion of insect protein in 2017.

Aquafeeds are becoming more and more complex, she noted, in order to meet increasing expectations related to nutrition, sustainability, cost, safety, technology readiness levels (TRL), social acceptance.

Animal proteins are rich protein sources, they provide well-balanced essential amino acids and have a potential probiotic effect (strengths). On the other hand, they need processing prior use (which requires energy), and lack omega 3 HUFA. “We shouldn’t replace fishmeal and fish oil because we may compromise the nutritional value of the fillet (omega3)” she insisted. While it must be noted that animal proteins may vary in nutritional value depending on species, latitudes and season, their main weakness is social acceptance.

There is an increasing demand in animal proteins and high technological developments are available. Moreover, local economic patterns are developing, which leads to lower carbon footprint. Main threats are related to legal issues, risks of fraud and adulteration, energy costs as well as religious limitations (e.g., use of swine products).

Johan Schrama, Professor at Wageningen University & Research, Netherlands, took a deep dive into novel ingredients, insisting on the huge diversity within the single cell protein category, encompassing microalgae, fungal and bacteria.

Considering that only 10% of the energy is transferred to the next tropic level, single cell proteins offer an opportunity to skip tropic levels (herbivore to carnivore, skipping omnivores). They need a lot of processing (the huge amount of water contained in single cell proteins requires a lot of energy to dry them) and are therefore energy intensive and have a high carbon footprint. Their main asset is they are climate independent and high in protein. Looking forward, single cell proteins could contribute to upgrading materials (substrates) which are not used for direct human consumption.

Last but not least, Dr Brett Glencross, Technical Director at IFFO, focused on marine ingredients, whose nutritional properties are recognised as the benchmark in feed qualities. Moreover, most fisheries in the world, in developed nations, are now seen as the benchmark of sustainability and recent price stability has surpassed that of other raw materials. Despite these positive aspects, social acceptance is low: public and eNGO perception is that fisheries are unsustainable. As with all finite supplies, capacity to increase production is low to zero. Fisheries around the world are exposed to climate change threats and political instability threatens agreed stock sharing arrangements.

However, opportunities lie ahead: marine ingredients can be easily value-added (fish solubles, fish protein hydrolysates), LCA footprinting characteristics of marine ingredients are among the best of all resources and potential for circularity in feed resource production is HUGE. The majority of fish caught and farmed is for human consumption, but less than 50% of that is eaten. This shows the potential for more circularity moving forward, as aquaculture keeps growing.

All presentations are available here.

Click here to watch the interview which International Aquafeed magazine did with Dr Brett Glencross (June 2022) in Sorrento.