Held in Xiamen city in China on the 3rd September 2024, the workshop brought together over a hundred participants from the marine ingredients industry.

Marine ingredients production in Asia

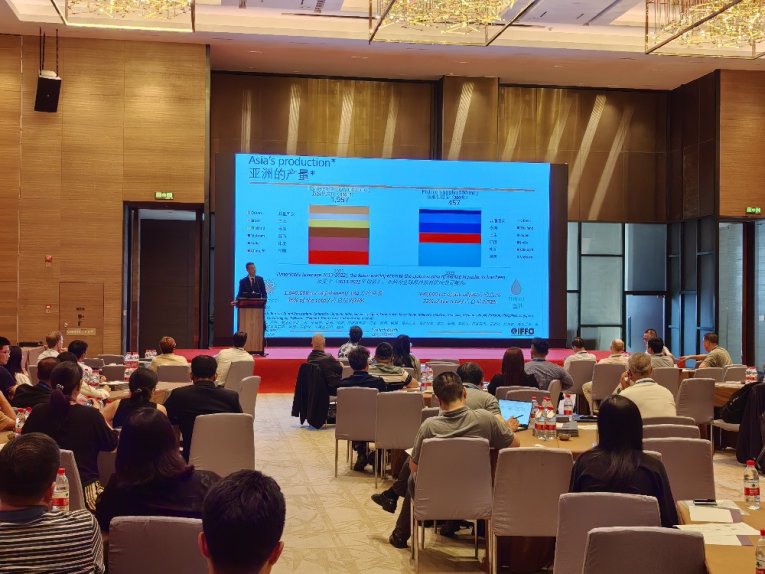

IFFO’s Market Research Director Dr Enrico Bachis provided an analysis of the 2023 production data in Asia and worldwide, showing the industry's resilience despite the many challenges, such as the El Nino / La Nina events: the global supply of both fishmeal and fish oil are in line with the last decade's average production, largely due to increased output from some Asian countries. Bachis noted that “Asian countries provide more than 30% of the fishmeal and fish oil produced worldwide, with growing intra-trade within the Asian region. However, Asia faces an annual gap between fishmeal and fish oil production and consumption, highlighting the importance of trade for the region.” Pelagic species play a smaller role in Asia in terms of raw material for fishmeal and fish oil in comparison to the rest of the world, with tuna, tilapia and pangasius being a relatively bigger source in Asia. By-products provide a key source of raw material in Asia, especially for fish oil production, he noted.

IFFO’s Market Research Director Dr Enrico Bachis provided an analysis of the 2023 production data in Asia and worldwide, showing the industry's resilience despite the many challenges, such as the El Nino / La Nina events: the global supply of both fishmeal and fish oil are in line with the last decade's average production, largely due to increased output from some Asian countries. Bachis noted that “Asian countries provide more than 30% of the fishmeal and fish oil produced worldwide, with growing intra-trade within the Asian region. However, Asia faces an annual gap between fishmeal and fish oil production and consumption, highlighting the importance of trade for the region.” Pelagic species play a smaller role in Asia in terms of raw material for fishmeal and fish oil in comparison to the rest of the world, with tuna, tilapia and pangasius being a relatively bigger source in Asia. By-products provide a key source of raw material in Asia, especially for fish oil production, he noted.

Unknown growth factor of fishmeal

Delving into the properties of fishmeal and fish oil, Prof. Haipeng Yang, a former chief researcher of China National Feed Quality Inspection and Testing Center (Wuhan city), presented his findings. Prof Yang showed how the properties of fishmeal vary and its value not only relates to protein, salinity and histamine, but also the content of essential fatty acids. Although EPA and DHA are the focus of fish oil pricing, the content of EPA and DHA in fishmeal should also be recognized in pricing as it provides ‘x growth factor’.

Fishmeal quality control

Moving to aquafeed, Prof. Yuantu Ye from Soochow University discussed the functional value of fishmeal and other marine organism feeds. He emphasized the importance of fishmeal quality control and low-temperature technology, while highlighting the adverse impact of histamine, malonaldehyde and gizzarosin in feeds on farmed animals.

Meeting the global demand for omega-3

Bringing a global perspective on omega-3, GOED’s VP of Data Science Aldo Bernasconi, presented the important role of EPA and DHA for public health and the challenge of increasing consumption globally. “EPA and DHA are essential for human health throughout life; however, over 95% of the global population does not get sufficient levels”, he noted.

Peru’s marine ingredient production

Providing an update on Peru’s fishmeal and fish oil production, Pesquera Diamante’s Commercial Manager Diana Guzman noted how the industry is significantly influenced by climatic factors, regulatory measures, and the biomass situation, which directly impacts the environment in which the anchoveta thrives. Guzman outlined the key conditions that must be consistently monitored to predict the outcomes of the fishing season. Guzman noted that “in recent years, China has become a buyer of oil for the omega-3 industry, requiring 20-25% of Peruvian production. As we know, Peruvian anchovy oil has a minimum of 28% EPA+DHA, which makes the product in demand by the most important supplement producers and the pharmaceutical industry. In Peru we can say that 80% of fish oil production is delivered to the world's omega-3 industry. That has meant a major shift in the fish oil business.”

Marine ingredients in India

Udaya Kumar Salian from Yashaswi Fish Meal and Oil Company in India gave an update on the marine ingredients industry in India. The primary species used are sardines, mackerels, scads, as well as trimmings from the surimi industry. The last three seasons have been very good for Indian fishmeal production, with an estimated 200,000 metric tons in the domestic aquaculture market. Indian fishmeal companies have made significant efforts to obtain certifications that meet international standards (such as GMP+, ISO etc), but none are yet certified against MarinTrust standard. There are currently two Fishery Improvement Projects (FIPs) underway in India, accepted onto the MarinTrust Improver Programme. FIPs are developed by interested marine ingredient producers and stakeholders, followed by a rigorous development process and action plan. Through improvements, such as in fisheries management, factory infrastructure, or operational issues, the aim is to meet the MarinTrust Standard requirements.

Fishmeal in China

Focusing on China’s fishmeal market, Lun Huang, the Animal Protein Purchasing Director from Tongwei Agricultural Development, presented on the gradual recovery of fishmeal resources global and impacts in China. Sales volume of aquafeed in China have declined with cost pressures increasing and inventory competition. Fishmeal import tariffs have been relaxed which has allowed the sources of fishmeal to greatly increase. Huang ended by echoing remarks from early presentations on the increasing focus on fishmeal quality enhancing competitiveness.

Growing resilience

Closing the workshop, IFFO’s China Director Maggie Xu stated that “without fishmeal and fish oil’s nutrients, the full growth potential of the animal cannot be reached. Long chain omega-3 fatty acids remain a critical component of nutrition for fish and human health. However, we’ve heard that less than 5% of the world population has a sufficient intake. On top of that, fishmeal quality control needs to be thoroughly implemented to maximise the growth performance of the fish.”

Closing the workshop, IFFO’s China Director Maggie Xu stated that “without fishmeal and fish oil’s nutrients, the full growth potential of the animal cannot be reached. Long chain omega-3 fatty acids remain a critical component of nutrition for fish and human health. However, we’ve heard that less than 5% of the world population has a sufficient intake. On top of that, fishmeal quality control needs to be thoroughly implemented to maximise the growth performance of the fish.”

Xu added that “as a natural resource, fishmeal and fish oil production is dependent on weather conditions and climate: after last year’s El Nino phenomenon, the industry is proving its resilience. Fishmeal resources all over the world are gradually recovering.”