The final session of IFFO’s conference included presentations from the demand side of marine ingredients.

Fishmeal and fish oil demand: an overview of the global trends

Dr Enrico Bachis, Market Research Director, IFFO presented IFFO’s 2023 data on the consumption of marine ingredients. Fishmeal exports declined, due to reduced fishing in Peru, but exports from India increased. Imports of fishmeal also decreased, with some reduction from China and the rest of the world were similar to 2022 figures. Total use of fishmeal reduced, with 90% going to aquafeed.

Looking at fed aquaculture, IFFO focuses on species that use fishmeal and fish oil, with a general decrease in consumption in 2023. Looking at aquaculture species, there is a drop across the board with the exception of marine fish. Consumption by pork markets in China has dropped dramatically due to negative margins in this industry. With pet food, consumption in premium dry pet food is slowly increasing, most notably in North America, Europe and Latin America, and a growing market in Asia.

For fish oil, exports were also down in most countries, but there was an increase in exports from China and Chile. For imports, again these dropped in China, but we saw a huge increase in the USA, mostly for Vietnamese pangasius oil to be used as biofuel. The drop in consumption was mainly driven by aquaculture, with lower inclusion rates, apart from in marine fish, which will likely be a temporary situation. For consumption in aquafeed, salmon is still the main consumer and a reduction in use by crustaceans.

Aquaculture vs capture fisheries

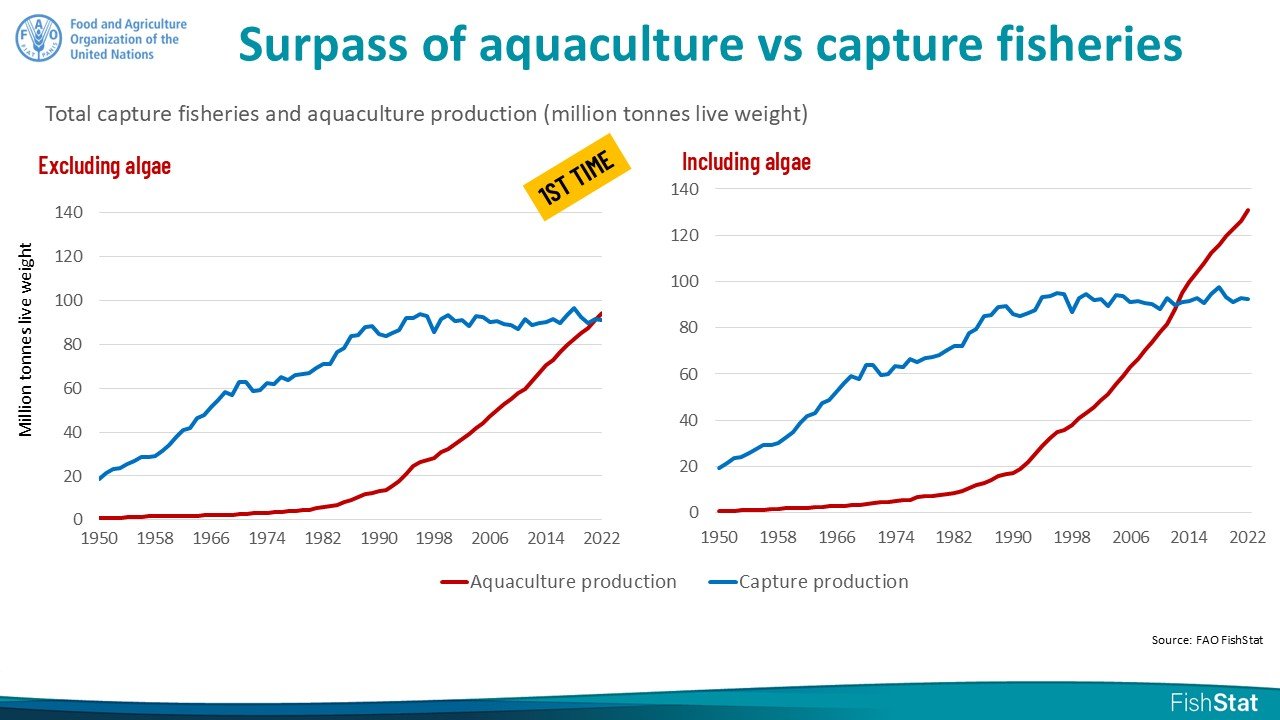

UN FAO’s Senior Fisheries Officer Stefania Vannuccini, who is one of the main authors of the biannual FAO State of Fisheries and Aquaculture (SOFIA), provided an overview of recent and expected trends, in terms of key species and producers. “World fisheries and aquaculture production is at a world time high, for both farmed fish and algae. The latest data shows that aquaculture production has surpassed capture fisheries, with the gap growing even further when adding in algae.” Focusing on aquaculture animals, 81% of the share is from Asian countries, but capture is more balanced with 41% for Asia. The share of aquaculture production is growing in all countries, with growth of 8% in Africa. Looking at species production, out of the top 10 species items produced, eight out of ten are from aquaculture. Asia aquatic food consumption has more than doubled since 1981 and as trade grows so does this sector’s important role in employment. With fisheries employing 62 million globally, capture fisheries now account for 54% of this.

UN FAO’s Senior Fisheries Officer Stefania Vannuccini, who is one of the main authors of the biannual FAO State of Fisheries and Aquaculture (SOFIA), provided an overview of recent and expected trends, in terms of key species and producers. “World fisheries and aquaculture production is at a world time high, for both farmed fish and algae. The latest data shows that aquaculture production has surpassed capture fisheries, with the gap growing even further when adding in algae.” Focusing on aquaculture animals, 81% of the share is from Asian countries, but capture is more balanced with 41% for Asia. The share of aquaculture production is growing in all countries, with growth of 8% in Africa. Looking at species production, out of the top 10 species items produced, eight out of ten are from aquaculture. Asia aquatic food consumption has more than doubled since 1981 and as trade grows so does this sector’s important role in employment. With fisheries employing 62 million globally, capture fisheries now account for 54% of this.

As population increases, more food will be required but not at the expense of the planet. “Aquatic foods are part of the solution and their role in sustainable aquatic diets is crucial. To achieve this, aquatic production will need to grow in regions especially in Africa by 74% and Oceana by 24% by 2050”. Vannuccini ended by noting that stocks are increasingly sustainable or improving with 77% of landings from sustainable stocks. “There is however a lot of work still to be done, taking into account the projected impacts on stocks from climate change, the industry needs to use more by-products”. Vannuccini projected that fishmeal projection will be stable in the coming years, but the industry needs to use all the resources.

Financing growth for the salmon farming industry

Providing a viewpoint from investment banking, Carl-Emil Kjølås Johannessen from Pareto Securities in Norway, noted that global stagnation of salmon supply has led to increasing salmon prices and high profits for farmers. Production is increasing in areas such as Norway and Chile and is expected to slightly increase in coming years. Demand is growing in most markets and prices have now stabilised and will likely continue.

Providing a viewpoint from investment banking, Carl-Emil Kjølås Johannessen from Pareto Securities in Norway, noted that global stagnation of salmon supply has led to increasing salmon prices and high profits for farmers. Production is increasing in areas such as Norway and Chile and is expected to slightly increase in coming years. Demand is growing in most markets and prices have now stabilised and will likely continue.

These tough market conditions have driven demand for initiatives and technology to increase production such as land based, closed system in sea, larger smolt and offshore is seen as alternatives. There is a lot of uncertainty, especially with recent regulations in countries like Norway. With land-based farming, success has happened with other species and focus is now on salmon, especially in Norway and the US, with some positive developments and production is expected in the next 10 years. Kjølås Johannessen added that to increase growth, investment is needed in technology which will predominately need to be financed with equity. There are more proven technologies and new projects entering the market, supported by large infrastructure funds and private equity firms, so movement is expected here. With traditional salmon farming, investment is focusing on new technology, closed systems and production efficiencies. Consolidation is happening in this market which bring increased efficiency and productivity.

Mediterranean aqua farming

Giving a perspective from Greek aquaculture, Nikos Papaioannou, the Chairman of IRIDA, noted that the region is experiencing rising supply and demand, and key markets, including increasing demand for sustainably produced food of high nutritional value. With the market being dominated by sea bass and sea bream produced in Greece and Turkey, Papaioannou noted that there is growing demand for ready to cook fish and deli items. Growth is expected between these two countries of around 5% in the coming years, but challenges remain, including overly hesitant regulatory restrictions. Prices have been challenging with production costs moving higher than prices, but it is expected to be more balanced going forward. Inclusion rates in these species are stable for fishmeal are around 18% and for fish oil are around 7.5%, and there are no trends to reduce inclusion going forward. However, challenges persist, including the design and production of high quality aquafeeds, health management, and environmental impacts. The industry is evolving with a market shift to certified products and producers, and the increasing quality of fishmeal and fish oil from this region.

Giving a perspective from Greek aquaculture, Nikos Papaioannou, the Chairman of IRIDA, noted that the region is experiencing rising supply and demand, and key markets, including increasing demand for sustainably produced food of high nutritional value. With the market being dominated by sea bass and sea bream produced in Greece and Turkey, Papaioannou noted that there is growing demand for ready to cook fish and deli items. Growth is expected between these two countries of around 5% in the coming years, but challenges remain, including overly hesitant regulatory restrictions. Prices have been challenging with production costs moving higher than prices, but it is expected to be more balanced going forward. Inclusion rates in these species are stable for fishmeal are around 18% and for fish oil are around 7.5%, and there are no trends to reduce inclusion going forward. However, challenges persist, including the design and production of high quality aquafeeds, health management, and environmental impacts. The industry is evolving with a market shift to certified products and producers, and the increasing quality of fishmeal and fish oil from this region.

China marine ingredient market

IFFO’s China Director Maggie Xu presented an overview of China’s marine ingredient market, looking at the recent supply and demand drivers. In terms of regulatory updates, the GACC Quarantine Import Permits are no longer required for fishmeal imports, and the registration system for foreign food exporters and Chinese food importers have been replaced by a more efficient online platform, increasing convenience for exports into China. Marine captures in China have declined following the implementation of conservation policies. Domestic fishmeal production has risen greatly, with 17% production from by-products in 2023. This rise has been driven by increasing prices, which has encouraged domestic production. Advancing technologies and sustainable policies is improving fishmeal quality. Domestic fish oil production has also increased with 29% coming from by-products. Imports have increased this year from Peru due to improved fishing conditions, with increases also from Chile and Ecuador.

IFFO’s China Director Maggie Xu presented an overview of China’s marine ingredient market, looking at the recent supply and demand drivers. In terms of regulatory updates, the GACC Quarantine Import Permits are no longer required for fishmeal imports, and the registration system for foreign food exporters and Chinese food importers have been replaced by a more efficient online platform, increasing convenience for exports into China. Marine captures in China have declined following the implementation of conservation policies. Domestic fishmeal production has risen greatly, with 17% production from by-products in 2023. This rise has been driven by increasing prices, which has encouraged domestic production. Advancing technologies and sustainable policies is improving fishmeal quality. Domestic fish oil production has also increased with 29% coming from by-products. Imports have increased this year from Peru due to improved fishing conditions, with increases also from Chile and Ecuador.

Moving to demand, aquaculture farmers are struggling with high prices and lack of confidence, causing a depressed market and decreasing aquafeed production. China’s pork market has been depressed but it is slowly improving this year with a steady rise in prices. Improving farming technologies is reducing dependency on fishmeal. Looking forward, lower local production of fishmeal in 2024 is expected to drive increasing imports in fishmeal. Fish oil exports may climb with support of the global direct human consumption markets.

Essentiality of the non-essentials in marine ingredients

Delving into the complexities of marine organisms, NOFIMA’s senior scientist Dr Antony Prabhu Philip, opened by saying that in order to appreciate the true value of marine ingredients, we must understand the marine organisms that they are sourced from. “With ever more challenging conditions in aquaculture, often overlooked non-essential metabolites in marine ingredients have a key role in feeds for carnivores and marine aquaculture species”.

Delving into the complexities of marine organisms, NOFIMA’s senior scientist Dr Antony Prabhu Philip, opened by saying that in order to appreciate the true value of marine ingredients, we must understand the marine organisms that they are sourced from. “With ever more challenging conditions in aquaculture, often overlooked non-essential metabolites in marine ingredients have a key role in feeds for carnivores and marine aquaculture species”.

Cold salt water provides challenging conditions for fish, with hydration being key to their survival, more than feed. Fish are made of 70-80% water and the fish need to maintain this, with a 2% drop causing dehydration. Aquaculture species are osmo-regulators as they evolved in fresh water first before returning to the marine environment. As these marine fish drink they need enough osmolytes to retain the water. Non-essential amino acids and their derivatives are protective for osmolytes. Conditions are even harder in cold water, due to a lower metabolic rate which decreasing their drinking rate. The role of osmolytes is therefore even more important in winter as the fish need more cell protection with this reduced drinking rate. “As we try to farm salmon on land and in other regions, these challenges will increase. Aquaculture needs to provide the fish with what they need”, Prabhu noted.

Feed formulations based on a precision nutrition approach are reducing non-essential amino acids and non-protein nitrogen. This is declining marine osmolytes and increasing plant osmolytes in winter, which could increase wounds, ulcers and mortality in salmon. “We need to acknowledge the role of osmolytes in feed and as a key source from marine ingredients. With 62.8 million salmon died at sea in 2023 (16.7%), mostly from diseases, wounds, osmoregulatory dysfunction should not be overlooked as we work to improve fish welfare” Prabhu concluded.

Update on fish oil trade

Looking at the fish oil markets, Christian Meinich, from Chr.Holtermann, gave an update on recent prices, which have dropped sharply and are now back at «pre-Niña/Niño» levels before 2023/2024. This increase is due to improved fishing conditions in Peru and carry-in stocks in 2024 feed segment. In omega-3 markets, the strained pipelines have partly refilled and feed markets have partly drawn on carry-in stocks to cover running consumption. He noted that there is still a two-tier market in feed grades depending on sustainability remains in place, with certified vs. non-certified oils.

Looking at the fish oil markets, Christian Meinich, from Chr.Holtermann, gave an update on recent prices, which have dropped sharply and are now back at «pre-Niña/Niño» levels before 2023/2024. This increase is due to improved fishing conditions in Peru and carry-in stocks in 2024 feed segment. In omega-3 markets, the strained pipelines have partly refilled and feed markets have partly drawn on carry-in stocks to cover running consumption. He noted that there is still a two-tier market in feed grades depending on sustainability remains in place, with certified vs. non-certified oils.

For EPA and DHA, there was a lack of availability last year, but this will now balance again with increasing from Peru and the growing use of algae oil. In terms of 2025 market outlook, there is some potential for further restocking of omega-3 segment pipelines towards previous levels, depending on supplies from Peru. There will likely be gradually tighter supply/demand for certified feeds, with reduced Scandinavian fishing quotas vs some growth in the salmon feed segment. Finally, EPA/DHA supply/demand will likely be more balanced.

Omega-3 Ingredient Market Update

Delving directly into the Omega-3 market’s, GOED’s Aldo Bernasconi noted that omega-3 ingredient demand grew in 2023, at a slightly slower rate, but is expected to continue growing in coming years. The fastest growing regions are in Asia (with the exception of APAC) and in the developing markets of the Middle East, with the US and Europe remaining essentially flat due to reduced supply, high prices and increasing refining of the oils. Growth in China was driven by fast-growing dietary supplement (DS) and pet nutrition segments. Most of the gains in ingredient demand were driven by increases in pet nutrition and specialty oils.

Delving directly into the Omega-3 market’s, GOED’s Aldo Bernasconi noted that omega-3 ingredient demand grew in 2023, at a slightly slower rate, but is expected to continue growing in coming years. The fastest growing regions are in Asia (with the exception of APAC) and in the developing markets of the Middle East, with the US and Europe remaining essentially flat due to reduced supply, high prices and increasing refining of the oils. Growth in China was driven by fast-growing dietary supplement (DS) and pet nutrition segments. Most of the gains in ingredient demand were driven by increases in pet nutrition and specialty oils.

Higher crude prices affected particularly common refined oils, with most of the gains in volume going to pet nutrition, while pharmaceuticals and direct supply remained flat. The volume of EPA+DHA used by the omega-3 market also grew modestly during 2023. Most crude oils used for omega-3 products come from anchovies, sardines and similar reduction species, or by-product from the seafood industry. Reduced crude oil supply and record fish oil prices in 2023 resulted in increased reliance on alternative sources, changes in production practices and in the market share of different ingredients. Bernasconi noted the need for the omega-3 industry to diversify and decrease reliance on Peru. Higher fish oil prices caused an increase in ingredient oil prices, but only a fraction of this was passed to the final consumers. Companies are now moving towards higher concentration premium products to retain cost vs price balance.

Why omega-3s are so important in regulating inflammation

Shifting focus to human health and the role of Omega-3s in regulating inflammation, Philip Calder, Professor of Nutritional Immunology in the Faculty of Medicine at the University of Southampton, explained where inflammation in humans comes from. Inflammation is linked to tissue damage, pathology and ill health. Calder presented the role of the omega-3 fatty acids EPA and DHA and how they affect the production of inflammatory mediators. “The anti-inflammatory and inflammation-resolving effects of EPA and DHA are important to both the prevention and treatment of human diseases that have an inflammatory component, with these features being important aspects of their value to human nutrition” he stated.

Shifting focus to human health and the role of Omega-3s in regulating inflammation, Philip Calder, Professor of Nutritional Immunology in the Faculty of Medicine at the University of Southampton, explained where inflammation in humans comes from. Inflammation is linked to tissue damage, pathology and ill health. Calder presented the role of the omega-3 fatty acids EPA and DHA and how they affect the production of inflammatory mediators. “The anti-inflammatory and inflammation-resolving effects of EPA and DHA are important to both the prevention and treatment of human diseases that have an inflammatory component, with these features being important aspects of their value to human nutrition” he stated.

Inflammation is part of host defence but can be damaging if it is not controlled and is linked with many conditions and diseases. EPA and DHA act through several mechanisms to modulate inflammation and these mechanisms link the membrane and the nucleus. EPA DHA also give rise to chemicals SPMs (specialised pro-resolution mediators) that reduce inflammation. The anti-inflammatory and pro-resolving actions of EPA and DHA are relevant to prevention and treatment of conditions. He concluded noting that EPA and DHA are “master controllers of inflammation.