Author: Brett D. Glencross, IFFO, The Marine Ingredients Organisation

This article was originally published in the March 2022 edition of FishFirst

Much of the usage of fishmeal over the past sixty years has been a story of changing demands over time. As one new industry with a higher and stronger demand emerges, it has taken over the share of the previous market, and that previous market has been forced to move on to other ingredients. The classic story here is the situation with the changes in fishmeal use between the poultry, pig, and aquaculture sectors over the past sixty years (Figure 1).

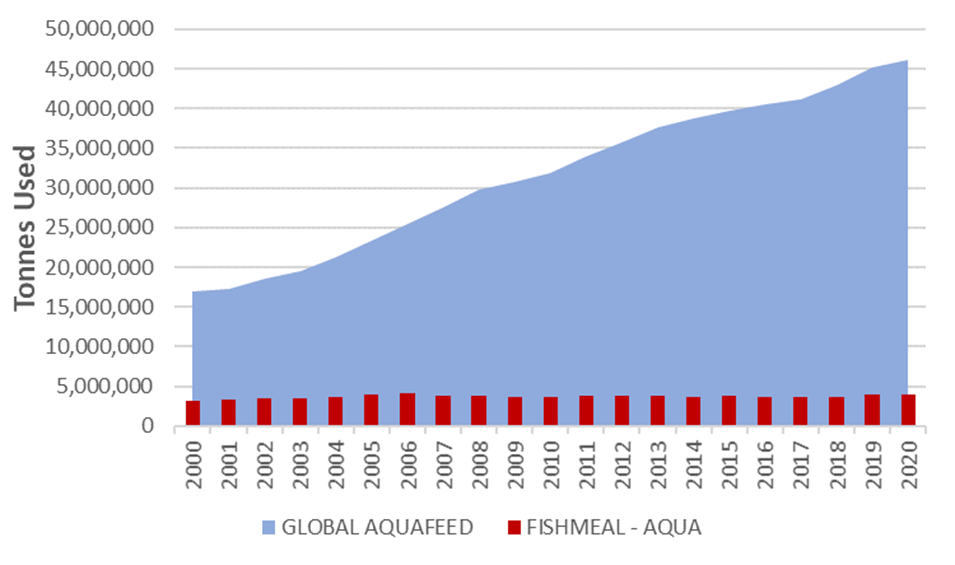

The role of fishmeal in the aquaculture story is well known, as being the feed ingredient that underpinned the development of feeds for intensification of aquaculture worldwide. However, it was also known back in the 1990’s that the raw material capacity of fishmeal production was finite and so much work was done on developing alternative ingredients for use in aquafeeds. Despite that work, fishmeal continues to be used in aquafeeds, in fact the total volume consumed by aquaculture has barely changed in the past twenty years despite that the feed production for aquaculture during this period has trebled (Figure 2). So, what is really going on here?

Just as we have seen changes amongst the poultry, pig, and aquaculture sectors over the past sixty years, even within a sector like aquaculture there are changing demands over time. Twenty years ago, salmon farming had become one of the big users of fishmeal, and fishmeal usage by that sector has somewhat plateaued at around 400,000 tonnes per annum. The largest user of fishmeal presently in 2020 is now the shrimp farming sector, which uses more than a million tonnes of fishmeal each year. Given that global fishmeal production is about 5 million tonnes and aquaculture accounts for close to 4 million tonnes of that, this means that about 25% of all fishmeal use in aquaculture is now for shrimp.

But what will the future hold? Will the shrimp sector increasingly consume more and more of that fishmeal, or is there another sector yet to take the lead in fishmeal consumption? Based on FAO estimates for aquaculture production over the next thirty years we could see aquaculture production reach 140 M tonnes. Much of that forecast growth is from marine fish, could they be the next market to lead? An analysis of the fishmeal inclusion rates across the aquaculture sector shows some stark differences among the various sectors. Yes, marine fish are one of those that use a high inclusion percentage, but there are others. One thing is clear though, the only constant in the feed commodities world is change.

Figure 1. Changes in fishmeal use by sector from 1960 to 2020. Source: IFFO 2022.

Figure 2. Global aquafeed production and fishmeal use by aquaculture from 2000 to 2020. Source: IFFO 2022.

Figure 3. Global fishmeal consumption by aquaculture sector in 2020. Source: IFFO 2022.