Insights from China

Focusing on markets and the demand of ingredients in China, IFFO’s China Director Maggie Xu presented a succinct overview remotely from Beijing. The performance of wild capture whole fish supply during the last quarter of 2022 is holding and China's yearly fishmeal and fish oil output is undecided. The fast growing ready-to-eat meal sector is bringing new hope to further increasing the supply of fishery by-products to domestic marine ingredients production. Peru still firmly occupies half of China's overall fishmeal imports, however new emerging markets from neighboring countries are increasing their imports.

Strong prices and weak currency rates are impeding marine ingredients imports, while the winding-down of the aquaculture season right now is also slowing down the rhythm of imports. Positive growth in the aquaculture sector continued from 2021 to 2022, but at this time of the year the China’s fishmeal market shifts from aquaculture to pig farming. The new pig cycle started this April, bringing increased production and profits and in turn, with sown inventory and piglet restocking now impacting the market. Finally, with no sign of changes to covid policies, the marine ingredients supply chain continues to be affected; but there is a firm determination to pull through.

Global trends of fishmeal and fish oil demand

Moving to a global view, IFFO’s Market Research Director Dr Enrico Bachis opened by explaining the data used by IFFO and how the estimates are calculated. Consumption is estimated is by taking the official FAO figures and then gathering specific data areas such as species and region, while also using various parameters such as FCR and inclusion rates.

Moving to a global view, IFFO’s Market Research Director Dr Enrico Bachis opened by explaining the data used by IFFO and how the estimates are calculated. Consumption is estimated is by taking the official FAO figures and then gathering specific data areas such as species and region, while also using various parameters such as FCR and inclusion rates.

Starting with fishmeal, the largest exporters were Peru, followed by Chile, Vietnam and Denmark. Countries with a large aquaculture sector tend not export fishmeal. For imports, China is the largest importer (almost 50%) of global imports, followed by Norway and Japan, who again have a large aquaculture industry. Historical trends on fishmeal use show that use continues to grow in aquaculture sector, poultry and pig sectors are slightly reducing, while petfood is growing. To aquaculture, sector growth is happening fastest in Asia and China, and for species crustaceans (shrimp) are increasing along with freshwater fish (especially in China). Finally, salmonids are the fourth sector in terms of consumption of fishmeal. To pigs, in 2019 and 2020, the market was severely affected by swine fever, but the market has now rebounded. Poultry, historically the largest consumer is now a small user of fishmeal and this is not expected to change.

To fish oil and petfood, the world’s production of dry food has increased by 15% and premium segment, which uses fish oil, is estimated at around 40% of dry food. Peru is again the leader in exports of fish oil, followed by Denmark, Norway and China. For imports, Norway is again the leader followed by other aquaculture producing countries. Looking at the use of fish oil, salmon is the dominant consumer, followed by crustaceans and then marine fish. By regions, feed formulations greatly affect consumption and Europe is therefore the leader, followed by Latin America. Consumption by the pharmaceutical sector increase by 5% and this is expected to continue.

Connecting and simplifying global supply chains

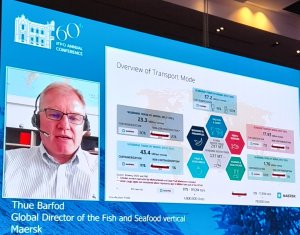

Maersk’s Global Director of The Fish & Seafood Segment, Thue Barfod, presented the practical challenges facing global supply chains, most notably from the COVID 19 pandemic. For fish and seafood, the sector was dramatically impacted by covid, with off-shore challenges on the fishing vessels, on-shore challenges in the processing plants, crew change challenges, GCA covid restrictions, and reduced demand in the F&E sector. However, trade is now growing again, but challenges remain with the global reefer trade issues with Latin America especially.

Maersk’s Global Director of The Fish & Seafood Segment, Thue Barfod, presented the practical challenges facing global supply chains, most notably from the COVID 19 pandemic. For fish and seafood, the sector was dramatically impacted by covid, with off-shore challenges on the fishing vessels, on-shore challenges in the processing plants, crew change challenges, GCA covid restrictions, and reduced demand in the F&E sector. However, trade is now growing again, but challenges remain with the global reefer trade issues with Latin America especially.

On-going additional challenges include stretched supply chains, China’s Dynamic “zero” covid policy, employment challenges, fuel increase, inflation, and other geo-political challenges. There are still huge blockages in ports around the around the world due to on-going transport capacity constraints. Barfod noted that in this landscape, the industry needs to remove inefficiencies with digitization and automatization (removing paperwork); and communicate future plans, especially on any early signs of disruptions. Longer-term two-way agreements at market relevant prices and shared/aligned supply chain strategies could strengthen the markets in the long term.

Omega-3 market demand grows but challenges remain

GOED’s Vice President of Data Science Aldo Bernasconi gave their latest insights into the Omega-3 market demand and future forecasts, this market is mostly consumer brands such as nutraceuticals and petfood. Globally, Omega-3 markets grew by 2.2% in 2021, with growth expected to continue, especially in Latin America and developing markets. Logistical issues and economic uncertainty have slowed growth in Asia. Volume grew in North America partly due to a corrector from record 2020 drops in demand for refined oils. Demand is moving to concentrates that have higher EPA and DHA amounts, increasing EPA and DHA volumes, infant formula in China is also driving growth. For crude oils, growth is increasing fastest again with nutraceuticals and petfood.

GOED’s Vice President of Data Science Aldo Bernasconi gave their latest insights into the Omega-3 market demand and future forecasts, this market is mostly consumer brands such as nutraceuticals and petfood. Globally, Omega-3 markets grew by 2.2% in 2021, with growth expected to continue, especially in Latin America and developing markets. Logistical issues and economic uncertainty have slowed growth in Asia. Volume grew in North America partly due to a corrector from record 2020 drops in demand for refined oils. Demand is moving to concentrates that have higher EPA and DHA amounts, increasing EPA and DHA volumes, infant formula in China is also driving growth. For crude oils, growth is increasing fastest again with nutraceuticals and petfood.

Looking forward, pharmaceutical approvals in China for omega-3 drugs are in the pipeline which could greatly impact markets. Growth in this segment would result in a large increase in demand of crude oils, but pharmaceuticals rely on high-EPA crude, which may limit the growth, or force changes in the dietary supplement market. Another continued impact is the effect of inflation, high inflation and historically high prices for crude fish oils will result in higher ingredient prices and finished product brands will eventually need to pass these price increases to the final consumer. Lastly, multiple companies are seeking to introduce genetically engineered seed oils with EPA and DHA. High fish oil prices could encourage this development, but consumer resistance and regulatory remain as a barrier to the introduction of these new ingredients.

Fish oil trade: balancing at all-time highs

Moving to fish oil markets, Chr. Holtermann AS Managing Director Christian Meinich gave an outline of the markets and likely future developments. With prices at an all time high, the last six months have been more of a balancing act, driven in part by lower production levels and strong demand from China for Omega-3. Rapeseed markets have been severely impacted becoming inflated earlier in the year due to the war in Ukraine, with interest growing in algae-based products, but they too have suffered from production bottlenecks.

Moving to fish oil markets, Chr. Holtermann AS Managing Director Christian Meinich gave an outline of the markets and likely future developments. With prices at an all time high, the last six months have been more of a balancing act, driven in part by lower production levels and strong demand from China for Omega-3. Rapeseed markets have been severely impacted becoming inflated earlier in the year due to the war in Ukraine, with interest growing in algae-based products, but they too have suffered from production bottlenecks.

For fish oil, menhaden production has been high, but Peru fishing and other markets have been lower. The difference between rapeseed oil and fish oil impacts the EPA and DHA value, which has sky-rocketed in recent months to the historic levels. The outlook for 2023 is expected to be a similar balancing act, the Peruvian fishing season is as always important, but continued impacts of the uncertain access to rapeseed oil will continue to disrupt the market. This will likely drive more demand for alternative sources (algae), which currently has a small market share, and this will likely increase gradually.

The future of feed: We can’t afford to be complacent

Back to the feed sector, Cargill’s Brad Rude and Dave Robb discussed the long-term sustainable growth of aquaculture and its feed. Demand for feed continues to grow, while feed efficiency and productivity improves. Growth is expected in all sectors of aquaculture due to seafood demand. Feed formulation has evolved to make the sector more resilient in a fast-changing global environment, with fishmeal and fish oil remaining at the core, but the raw material basket does continue to broaden.

Back to the feed sector, Cargill’s Brad Rude and Dave Robb discussed the long-term sustainable growth of aquaculture and its feed. Demand for feed continues to grow, while feed efficiency and productivity improves. Growth is expected in all sectors of aquaculture due to seafood demand. Feed formulation has evolved to make the sector more resilient in a fast-changing global environment, with fishmeal and fish oil remaining at the core, but the raw material basket does continue to broaden.

Alternative ingredients continue to gain momentum with some winners and some challenges, with GMO plant oils having a slow start due to regulatory processes and market concerns. Insect protein production will increase exponentially in the years to come as several companies finalize plants. Algae omega-3 products are also gaining momentum and capacity is expected to multiply in the coming years. For single cell proteins (SCP), they are still in the early phase of scaling up, but several plants are coming online. New SCP technologies using CO2 as carbon source also offer opportunities to produce proteins with very low emissions. With both algae and SCP production represent scalable solutions (add fermenters) at a moderate cost.

Regulatory and standards landscapes continue to evolve with feed standards strengthening to address transparency, contaminants (especially environmental), GHG emissions, and changing social issues. Legislative requirements are providing another challenge and becoming increasingly complex, especially in the EU and US. Aquaculture must grow, but that growth needs to be sustainable and marine ingredients will remain a key component of aquaculture feeds, but we must not be complacent. The industry must clearly differentiate from the risk areas of fisheries and play to our strengths, such as that they provide excellent nutrition, and are low in GHGs. Transparency and certification allow feed companies, farmers and retailers to standard up to scrutiny and most importantly increase trust. We need more raw materials and resilience, and fishery improvement programs are an important tool to guarantee this. We must work together to continue to improve fishery management and communicating clearly to stakeholders and consumers. Collaboration and communication are vital so we can understand the opportunities and risk that we face and solve them together.